Minnesota Senate passes tax bill with Social Security cuts, one-time rebates

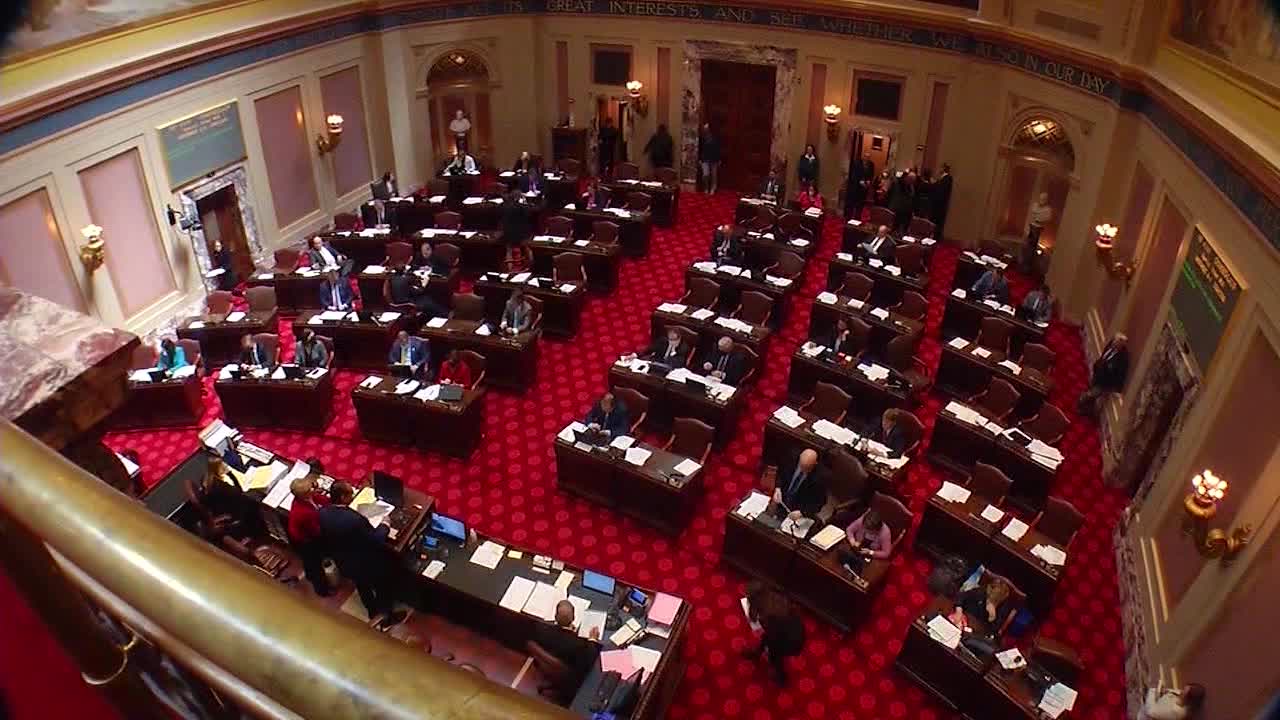

FILE - The Minnesota Senate chambers are shown at the State Capitol Building. (KSTP/file)

The Minnesota Senate passed its tax bill, which includes provisions for Social Security income tax cuts and one-time tax rebates.

The DFL-backed bill passed along party lines Tuesday night, 34-33.

Senate Tax Committee Chair Ann Rest, DFL-New Hope, touted the bill as “the largest package of tax cuts in state history,” claiming it provides $4 billion in tax cuts, credits and rebates.

Under the proposal, single taxpayers earning up to $75,000 would get a $279 rebate, with couples receiving $558 for households earning $150,000 or less. That’s slightly more than what was proposed in the House. Taxpayers would also be eligible for an extra $56 per child for up to three children.

RELATED: Minnesota lawmakers tackling public safety, taxes

The Senate’s tax bill includes reductions on Social Security income tax for most seniors but doesn’t eliminate it entirely, as Republicans have been calling for.

“The fact that Democrats can’t find it in their $72 billion budget — a growth of 40% — to give seniors a tax cut is very disappointing,” Senate Minority Leader Mark Johnson, R-East Grand Forks, said in a statement. “It’s [a] broken campaign promise. There are 33 votes for a clean repeal of the tax on social security from Republicans, but not one Democrat would join us. That’s something I hope everyone hears about when they go home.”

The bill also includes a Child Tax Credit of $620 per child for up to three children for families making $80,000 or less.

Other highlights include a measure to pay off U.S. Bank Stadium early and imposing a multinational corporation tax that would require companies to pay Minnesota tax on overseas profits, a move that Republicans labeled as a “risky move” that could compel companies to move their operations out of the state.

Republican amendments to expand sales tax exemptions for baby products and prohibit the state from collecting information on sales tax-exempt firearm storage purchases were bundled into the final bill.

Still, the House and Senate will have to reconcile their differences before sending a unified tax bill to Gov. Tim Walz’s desk.