Students call for U of M to divest from Israel at Friday’s Board of Regents meeting

An overflow crowd packed the McNamara Alumni Center Friday as the University of Minnesota Board of Regents met for their May meeting.

The board heard impassioned arguments for and against the school divesting from companies with ties to Israel or the war in Gaza.

“An educational institution should not be funding crimes against humanity,” declared Luzia Santos Stern, with the UMN Divest Coalition.

“I am really concerned that it feels like the money that I am paying for tuition is currently going toward human suffering instead of bettering the world,” added Nate Wulver, a U of M student.

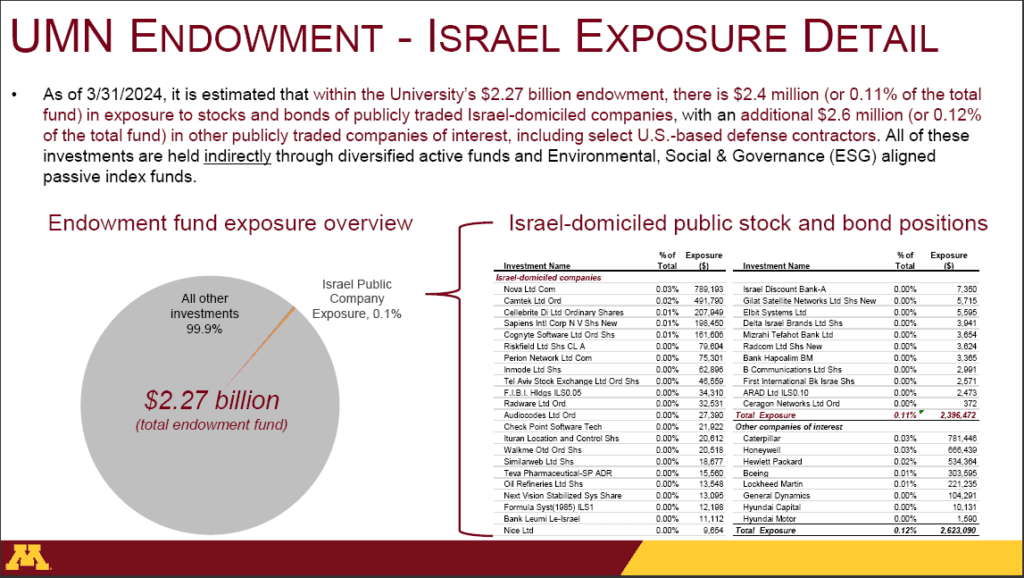

Earlier this week, the university released figures that show about $5 million in endowment funds are invested in 33 Israel-based companies and eight U.S. firms, including defense contractors.

That’s less than 1% of the overall endowment of nearly $2.3 billion.

However, students on Friday demanded that number be zero.

“We know that the Board of Regents has the power to begin the divestment process from Israel. The University of Minnesota began divestment from fossil fuels in 2021, human rights violations in Burma in 1998, and the South African apartheid in 1985. Now is the time for the board to consider doing the same for the Israeli apartheid,” another student testified.

But there were other concerns expressed during the meeting.

Members of the Jewish student group Hillel decried antisemitism on campus and called for the board to look at the divestment issue with fresh eyes.

“This year has been filled with more hatred targeting Jewish students based on our identities than ever before,” said Charlie Maloney, the group’s incoming president. “It’s not too late to teach the University of Minnesota community that you believe peace is possible, that Zionism isn’t a dirty word and that investing in Israelis and Palestinians can be more potent than divesting.”

But how quickly or easily could divestment occur at the University?

According to Dave Vang, an economics professor at the University of St. Thomas, it can be a pretty complex process.

“The University of Minnesota, like many universities, essentially subcontracts out their investing to a number of different fund managers,” he explains.

Vang says divesting specific funds or stocks can be done, but it would be time-consuming and expensive.

“Nothing’s impossible if you throw enough money on it,” he notes. “If you’d be willing to sacrifice enough of a return to through all the expenses and the accounting to make that happen.”

The board didn’t take any action Friday, but a university spokesperson says the panel could decide to discuss or review divestment at its next meeting in June.

“We have much work ahead of us. I appreciate the channels of communication that have been opened,” said Regent Janie Mayerson. “I remain optimistic that together, we will continue to navigate these tumultuous times, by keeping our focus on student support and open and genuine dialogue.”