Minnesota lawmakers consider expanding film tax credit program

Minnesota lawmakers are considering expanding the state’s film production tax credit program two years after it was implemented.

In 2021, the Legislature enacted a 25% income tax credit to production companies that spend at least $1 million dollars, in a taxable year, for eligible production costs. The measure passed with bipartisan support.

According to the Department of Employment and Economic Development (DEED), it’s first come-first serve until the program’s annual $5 million cap has been allocated. Unused allocations roll over to the next fiscal year.

New legislation would remove the program’s sunset provision and increase the annual cap to nearly $25 million dollars.

“It puts us in a much more competitive position,” said Melodie Bahan, the executive director of MN Film & TV. “Tax credits in other states range from $25 million dollars up to $420 million dollars or no cap at all.”

(KSTP)

More than 30 states currently have a film incentive program. Each is different, with various types of tax credits and rebates offered.

New York State’s program has a $420 million dollar cap, while there’s no limit on how much Georgia can spend on its program. Other states, including Kentucky, New Jersey, and Pennsylvania also have higher caps between $75 to $100 million dollars.

Caps in states such as Virginia, Rhode Island, and Montana are lower and fall between $6.5 to $12 million dollars.

“Incentives really changed the industry in a big way, to the point where they’re pretty much baked into the budgeting process,” Bahan said. “A producer or a studio will mock a budget up of what it would cost them here, how far their money would go with an incentive, and then they’ll do the same for another state, and then they’ll compare them.”

Since Minnesota enacted its program in 2021, three feature films have been approved and completed. The films cost a combined $8.3 million.

There are seven other projects currently in production, including four feature films, a documentary, a TV series, and a commercial package. Each project costs between $1.1 million dollars and $3.5 million dollars.

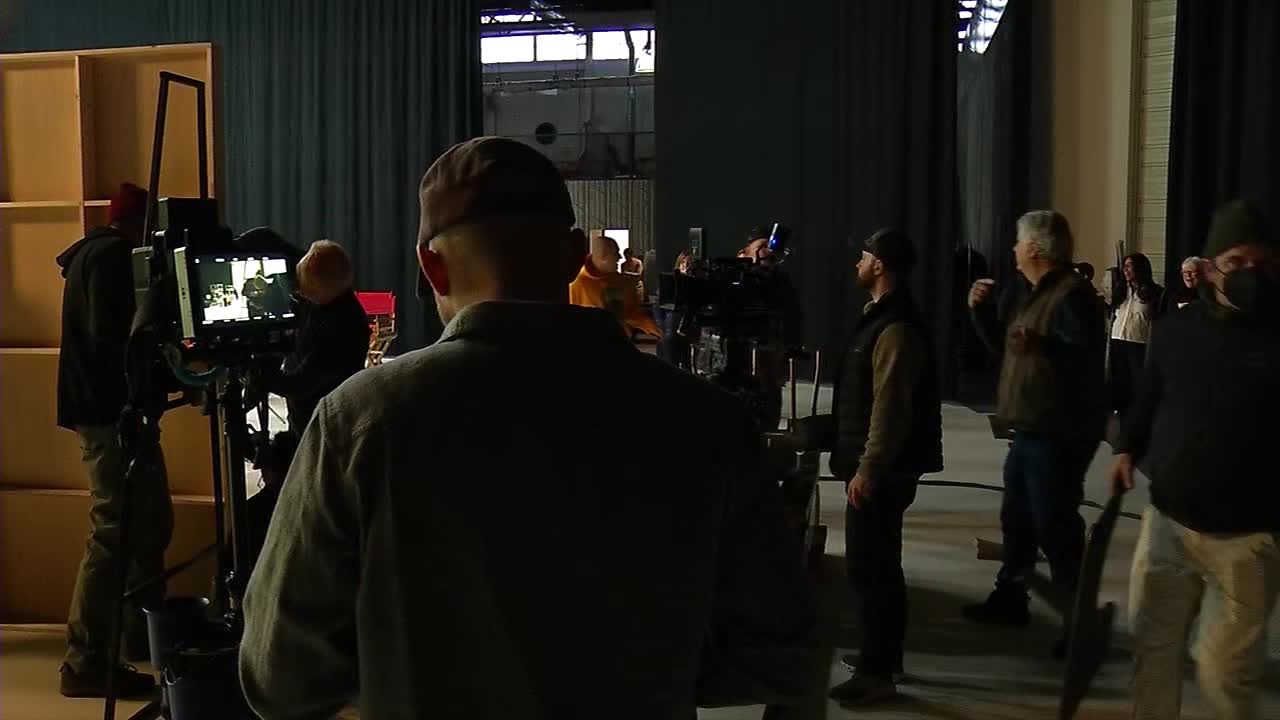

Tasty Lighting Supply and Acme Stage worked on each of the first three feature films that tapped into the state’s new program.

“The tax incentive brought in the movies last year that increased our revenue 10% across the board, and that was a huge difference for us,” said Michael Handley, the owner.

His company provides rental lighting, dollies, grips, tents, heaters, chairs, and other production equipment.

The Minneapolis studio also transformed into a set for the Signature Films production ‘Marmalade,’ which follows a man in jail as he tells the tale of a romantic bank heist.

“They actually recreated a little prison cell, and they shot that scene here,” said Handley.

The film features Camila Morrone, Aldis Hodge, and “Stranger Things” star Joe Keery. It was shot at several locations throughout Minnesota last summer.

Handley said films are “always advertising for the state,” including years after production has finished.

“It’s that if somebody watches that movie 10 years from now, the money spent this year extends out 10 years,” he said. “It’s a great way to put Minnesota on the map.”

Advocates of the proposed changes to Minnesota’s program say it could open the door to larger programs for the state.

“A television series, a one-hour drama, will spend anywhere from $8 to $12 million dollars per episode,” said Bahan. “That is a year-round kind of employment for people, or long-term employment. That’s our goal is to be able to bring that kind of project that’s going to put down some roots and stay here.”

Handley, who got his start running cable on the set of The Mighty Ducks, believes it will also create a pipeline of industry workers.

“It’ll give people in the cities, people in the Iron Range, people in the outstate areas – whether you’re a production assistant, a craft service person doing food, somebody doing wardrobe, someone being an electrician or a grip or a camera assistant – it gives all of those people the ability to start working those jobs in this industry,” said Handley.

The bill has progressed in both the House and the Senate with bipartisan support. It’s been laid over for possible inclusion in the tax omnibus bill.