Student loans and credit cards fuel spike in bankruptcy filings in Minnesota

The stack of unpaid bills kept creeping higher for Jenny George of Red Wing, Minnesota.

Despite a good-paying job with Goodhue County, George fell into a financial spiral due to rising costs, interest rates and a trip to the emergency room that blew up her monthly budget.

“I was at the point where I was really having to watch pennies to buy food,” she said.

The end of a three-year-long pandemic-era pause on student loans last fall added to her stress.

George owed just shy of $60,000 in student loans — and that’s not counting credit card and medical bills, which brought her total debt to more than $93,500.

“It just kept getting worse and worse,” she said.

George, who filed for Chapter 7 bankruptcy late last year, is among a growing list of people taking the desperate legal step in Minnesota.

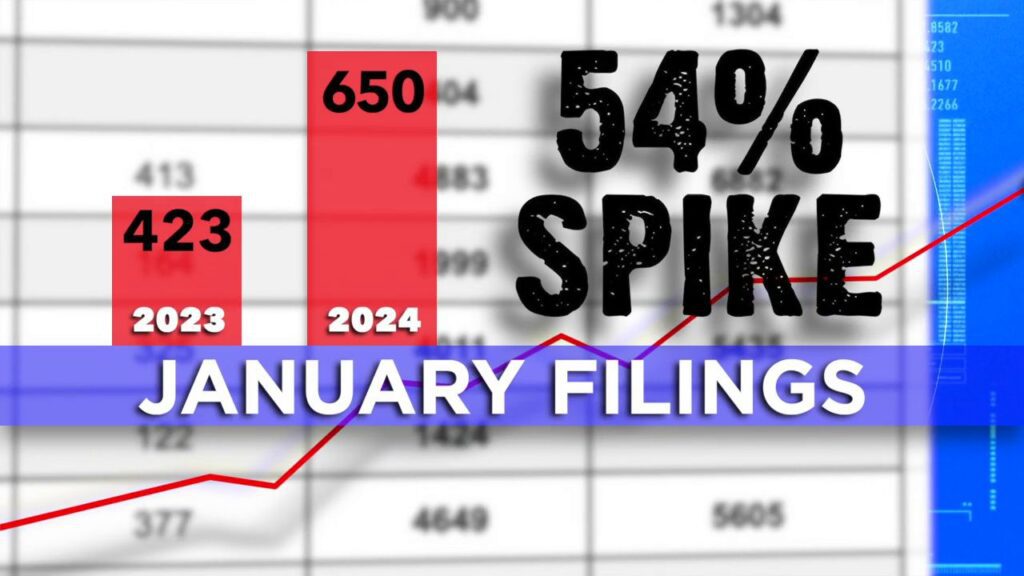

Court data reviewed by 5 INVESTIGATES shows the number of personal bankruptcies climbing in Minnesota: January saw a 54% spike in filings year over year.

“Everything I’m seeing says there’s an uptick,” said Randy Seaver, a bankruptcy trustee for more than 25 years with the Moss and Barnett law firm in Minneapolis. A trustee is a sort of court-appointed referee to make sure everyone plays by the rules.

“One of the primary factors would be the end of the moratorium on student loans,” he said. “So people are paying student loans again, and interest rates going up certainly doesn’t help.”

5 INVESTIGATES analyzed two weeks’ worth of recent bankruptcy filings in Minnesota — which amounted to nearly 250 cases.

The total debt during that period added up to about $48 million, including roughly $6 million in student loans. Nearly half of everyone who filed listed student loans among their debt load.

George struggled to come up with the money when her student loans suddenly came due again last fall.

“We all knew it was coming but, you know, we get into human habits,” she said.

As 5 INVESTIGATES first reported late last year, a rush of former students went to court to take advantage of a new provision that makes it easier to erase student loans in bankruptcy if a person can prove an undue hardship. Previously, those who emerged from bankruptcy still had to pay back student loans.

George is hoping this new measure will discharge nearly $60,000 in student loans. Her case is pending.

But bankruptcy filings clearly show credit card debt remains king.

Data from the New York Federal Reserve shows the average credit card holder in Minnesota carries a roughly $3,700 balance.

“That’s really putting a squeeze on everybody’s budget,” said John Lamey, a bankruptcy attorney out of Oakdale.

Lamey finds that most of his clients have multiple credit cards and balances they will never catch up on.

Data from the Federal Reserve now backs that up, showing that more than 6.65% of credit card holders in Minnesota have fallen behind on payments.

“I think people start putting expenses that maybe should be paid out of their bank account on the credit card, and it just kind of starts to snowball over time,” he said. “And if their wages aren’t going up, then something has to give.”